Contents

The capital record quantifies and represents every monetary transaction in an area that doesn’t affect the country’s investment funds, creation or payment. Efiling Income Tax Returns is made easy with ClearTax platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. The capital account of the proprietor is shown as the owner’s in the company balance sheet.

Capital a/c – representing the owner of the business, a person or organisation. The elements or accounts which represent persons and organizations. We’ve already provided you with the definition in the article. You don’t need professional support or deep knowledge in accounting to understand the capital meaning in accounting. It refers to the mix of competition and collaboration between businesses.

- Capital refers to the liquid assets that are procured by a company to be used for its expenses.

- In certain jurisdictions, there may be an upper limit to the number of partners but, as that is a legal point, it is not part of the FA2 syllabus.

- According to Section 2 of FEMA, Capital Account transactions are those which alter the assets or liabilities, including contingent liabilities outsid…

- Capital may also reflect the capital gained in a business or the assets of the owner in a company.

They purchase shares and procure profits relying upon the number of offers they own. They do have to cast a ballot right dependent on the offers they own. Company creditors need expenses before when the final distributions are made. So, the shareholders must be aware that they could get less than they initially contributed to the company is dissolved. This can be a great incentive to remain at the forefront of debts the company owns.

View all offers

As it is a business, the partners seek to generate a profit. The purpose of this article is to assist candidates to develop their understanding of the topic of accounting for partnerships. As such, it covers all of the outcomes in Section H of the detailed Study Guidefor FA2. https://1investing.in/ It also provides underpinning knowledge for candidates studying FFA/FA but it is not intended to comprehensively cover the detailed Study Guidesfor those exams. NEO by Axis Bank Path breaking digital banking platform that delivers highly customized solutions for you.

Capital Adequacy Ratio is the ratio of a bank’s capital in relation to its risk weighted assets and current liabilities. If you start a company, you’re supposed to invest some money to get started. You may need to take out a personal loan to get the money to be used as an investment in the company. When you start a company and want a bank loan, the bank would like to see what you have invested in the business. If the owner does not have an interest in the company, he or she can walk away and leave the bag holding the money. At the end of the financial year, the account is adjusted with the share of the profit or loss.

Online Inward Remittance

So, if you are following this method, capital account with credit balance appears on liabilities side. On the contrary, capital account with credit balance appears on the assets side of the Balance Sheet. Transactions related to income, expense, profit and loss are recorded under this category. These components actually do not exist in any physical form but they actually exist. For example, during the purchase and sale of goods, only two components directly get affected i.e money and stock.

Here you can find the meaning of Capital Account is a _________.a)Real A/cb)Personal A/cc)Nominal A/cd)None of theseCorrect answer is option ‘B’. Besides giving the explanation of Capital Account is a _________.a)Real A/cb)Personal A/cc)Nominal A/cd)None of theseCorrect answer is option ‘B’. Has been provided alongside types of Capital Account is a _________.a)Real A/cb)Personal A/cc)Nominal A/cd)None of theseCorrect answer is option ‘B’.

Cash/Cheque Collection

For example, there are three partners in a firm say, A, B, C. There will be three capital account – A’s capital account, B’s capital account, C’s capital account. A capital expense or capital expenditure refers to the government’s amount of cost or a business organization for buying assets. The assets bought through capital funds are fixed assets such as machinery, equipment or property, etc.

Capital can also be derived by deducting or withdrawing unit investments or investments in the public sector.

The capital account balance will tell economists if the country is a net exporter or importer of capital. Partner’s Capital account is that account capital account is a type of which records the transactions that takes place between partners and the firm. A separate capital account is maintained for each partner.

ClearTax serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. Capital may either be cash, machinery, receivable accounts, property, or houses. Capital may also reflect the capital gained in a business or the assets of the owner in a company. This value is credited to the old partners in the old profit and loss sharing ratio – ie 4/7 (or $24,000) to Amit and 3/7 (or $18,000) to Binta. The interest on the loan will be a business expense and should therefore be debited to the statement of profit or loss. It is worth pointing out that when a question states the profit or loss sharing ratio, that the proportions arealwaysapplied to the residual profit – not the profit for the year.

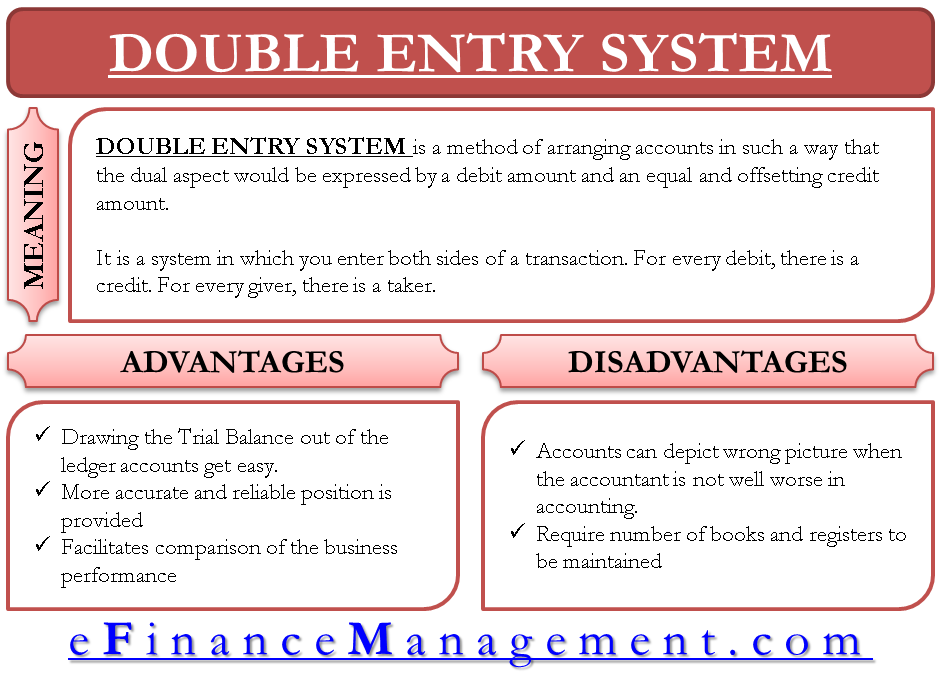

Capital is an asset because of its ability to add value. Capital in accounting can be determined by looking at your accounting records. Using a reliable software solution like TallyPrime will ensure each record is accurate and trustworthy. This will enable you to make wise decisions based on where to invest and how much to invest. In accounting, every transaction has a dual entry – debit and credit.

The goodwill account is created by a debit entry of $42,000. Applying the golden rules of accounting will help you determine the journal entries. With reference to the role of foreign trade in economic development, which of the following statements is correct? It helps to reduce poverty completely in all developing countries.

What is Partner’s Capital Accounts? Types of Partners Capital Account

Balances of members must always reflect their contributions to the business, less any money the business is contributing. Are an opportunity to determine the number of money individuals will earn if they sell their businesses. Investors are the most valuable asset in an organisation. They purchase shares and make a profit based on the number of offers, and they need to vote according to the offer they have. Foreign government institutions or governments endorse other loans not within the country.

Consult a professional before relying on the information to make any legal, financial or business decisions. Khatabook will not be liable for any false, inaccurate or incomplete information present on the website. The capital account records principal assets and obligations related to the government, including capital receipts from the government. The deficit was at $9.7 billion, or 1.3% of the GDP, a year ago. ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India.

Debit Cards

They are then eligible to receive dividends which depends on how many shares they have purchased of your business. They keep a record of the profits they earn in their capital account of their balance sheet. When the time comes, dividends are paid to the various shareholders of Forever Mode. If Darren owns 50 shares, he gets 50% of the dividends. Someone with 10 shares will get 10% of the dividends and so on.